Top Bookkeeping Mistakes That Sink Small Businesses (How to Fix Them)

Running a small business isn’t just about doing what you love. It’s also about keeping your finances in check—something that many business owners struggle with. At A&I Financials, we see it every day. Amazing entrepreneurs with great ideas stumble because of one thing: bad bookkeeping.

Let’s keep it real—no accountant-speak here. Just clear, simple advice on how to avoid the most common bookkeeping mistakes small businesses make.

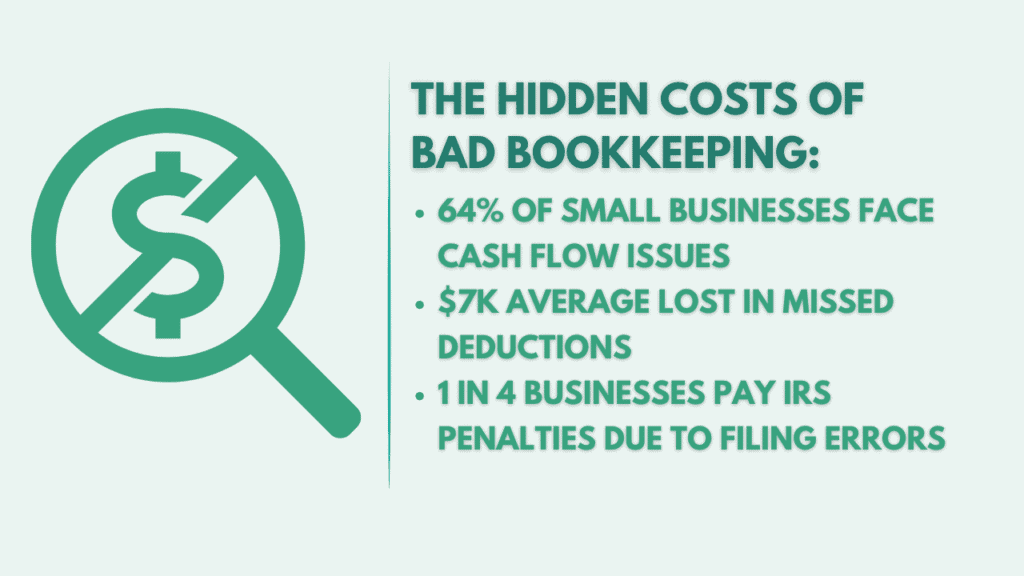

The Real Cost of Bookkeeping Mistakes

Bookkeeping errors might seem harmless at first. But here’s what usually happens:

- You lose track of cash.

- You miss out on deductions.

- You scramble during tax season.

- You pay fines for late filing.

- You never really know how your business is doing.

Ever felt this way? You’re not alone.

The #1 Reason Small Business Owners Mess Up Their Books

Many small businesses fail at bookkeeping because they try to do everything themselves. And why not? You’re trying to save money, right?

But here’s the truth:

- You didn’t start your business to crunch numbers.

- Bookkeeping is a skill. It takes time.

- Mistakes cost you more in the long run.

Trying to DIY leads to recordkeeping errors, missed payments, and tax filing mistakes. These small cracks can sink your business if left unchecked.

3 Signs Your Bookkeeping Is Failing

Recognize any of these?

- You’re always guessing how much cash you have.

- Tax season feels like a nightmare.

- You forget to invoice clients (and lose money).

These are classic bookkeeping problems small businesses face.

Small Business Bookkeeping Challenges That Hold You Back

Here are some of the top issues we see:

- Mixing personal and business expenses

- No regular system for tracking

- Inconsistent records

- Using outdated or confusing software

- Not reconciling bank statements

These are the real reasons small businesses fail at managing finances. You can fix them—but only if you spot them early.

Why Bookkeeping Is Hard for Small Businesses

You’re running the show. Sales, marketing, customer service—it’s all on you. No wonder bookkeeping for entrepreneurs often takes a back seat.

Plus, the software can feel overwhelming. What should be a simple process turns into a maze of spreadsheets and confusion.

That’s why many small businesses either ignore it or put it off. But the longer you wait, the worse it gets.

Real Story: How Maria Saved Her Business

Maria runs a bakery. She’s great at baking, not at finances. She used one bank account for everything. Business, groceries, rent—all mixed together.

Come tax time? Total mess. She missed deductions, paid extra tax, and was stressed.

She came to A&I Financials, and we cleaned it up. We helped her set up the right accounts, track expenses, and get ahead. She saved $12,000 in taxes that year.

Bookkeeping Mistakes That Lead to Business Failure

Don’t wait until you’re audited to get help. Poor bookkeeping causes:

- Cash flow issues

- Payroll and invoicing errors

- Inaccurate reporting

- Financial mismanagement

- Audit risks

This is how small business bookkeeping fails—quietly and quickly.

Small Business Bookkeeping Tips That Actually Work

Here’s how to stay in control:

Weekly

- Record all income and expenses

- Reconcile cash and cards

- Send or follow up on invoices

Monthly

- Reconcile your bank account

- Review your profit and loss

- Pay bills on time

Quarterly

- Pay estimated taxes (if applicable)

- Review your budget

- Check your growth

These bookkeeping best practices are your safety net.

Best Bookkeeping Software for Small Businesses

If spreadsheets aren’t cutting it, here are solid tools you can try:

- QuickBooks: Great for most industries

- Xero: Sleek, easy to use

- Wave: Free for basic needs

- FreshBooks: Perfect for invoicing

Avoid accounting software misuse by getting help during setup. A few hours of help now saves you hours of cleanup later.

How to Fix Bookkeeping Mistakes Fast

- Go back 3 months and log every expense

- Match receipts to bank transactions

- Reconcile accounts manually

- Use accounting tools to spot gaps

- Call a pro (we can help with this!)

FAQ: Bookkeeping Questions Business Owners Ask

Every week, if not daily. Small tasks now prevent big problems later.

Wave or FreshBooks. Both are user-friendly and built for beginners.

Absolutely. It’s one of the most common causes of small business collapse.

Mixing personal with business, forgetting to invoice, and not reconciling accounts.

If you’re spending more than 3 hours a week on it—or if it stresses you out—yes.

Your Next Step: Fix Your Books Before They Break You

If any of this sounds like your business, don’t panic. You’re not failing. You’re learning.

But now it’s time to take action.

📞 Book a 15-Minute Call & Stop Stressing Over Your Finances!

Or better—

Get a FREE Bookkeeping Health Check—Fix Your Books in 30 Minutes!

Let A&I Financials take the weight off your shoulders.

Final Tip Before You Go

💡 Pro Tip: Spend 10 minutes every Friday updating your books. It sounds simple, but it prevents 90% of the problems we’ve seen over the years.

Now that you know why small businesses fail at bookkeeping, you can avoid the mistakes, clean up the chaos, and build a business that lasts.

Your books matter. Let’s make them work for you.