Is Virtual Bookkeeping Profitable? 1 on 1 Comprehensive Analysis

To ensure accurate and comprehensive records of all financial transactions in your rewarding business, bookkeeping is the need of the hour. Bookkeeping serves several essential functions for a business, including legal compliance, financial management, budgeting and forecasting, fraud detection, improved decision-making, and increased transparency and accountability.

It provides a clear picture of the financial position of a business, and the information it provides is essential for making sound business decisions.

What is Virtual Bookkeeping?

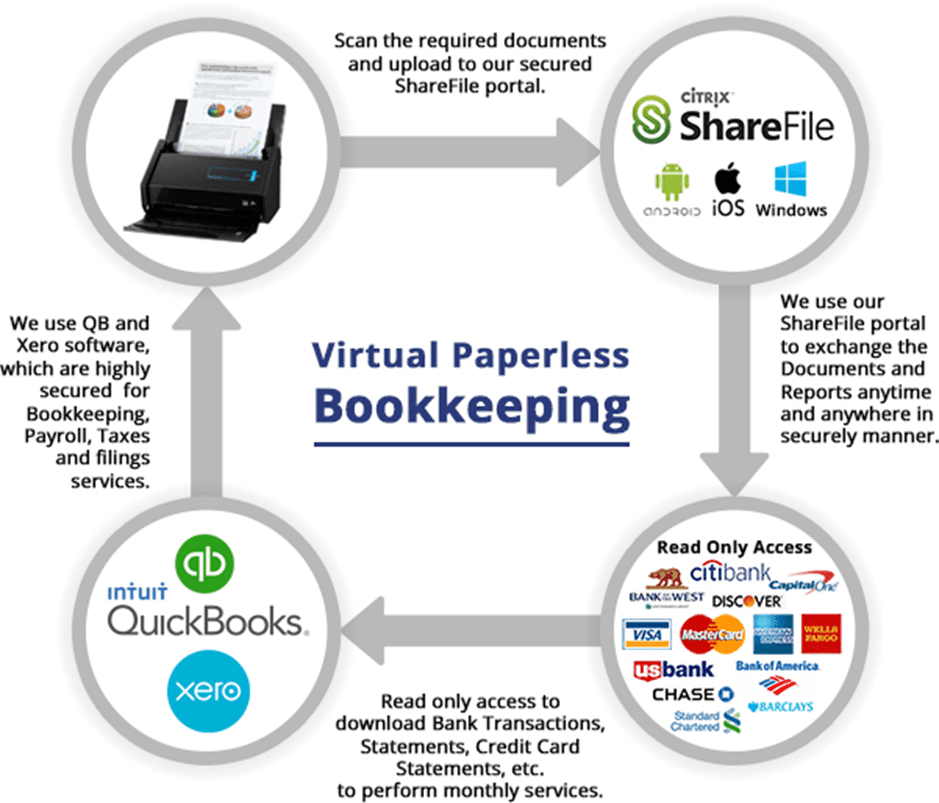

Virtual bookkeeping is maintaining a business’s financial records through digital means and software. It allows for easy access and management of financial data from remote locations.

It eliminates the need for traditional, in-person bookkeeping methods and physical bookkeeping materials or physical office space. Also, it is a cost-effective and efficient method of maintaining financial records.

How does Virtual Bookkeeping Work?

Virtual bookkeeping works through tools that can automate many of the manual processes involved in traditional bookkeeping and make it easier to track financial transactions and manage financial records.

Here are the steps on how virtual bookkeeping works:

Data Input:

Financial transactions, such as sales, expenses, and payments, are entered into the virtual bookkeeping software or tool. This can be done manually or through automated means, such as through integrations with accounting software or point-of-sale systems.

Classification and Categorization:

The classification and categorization are done by classifying the financial transaction and then sorting it into the relevant accounts and categories, such as accounts receivable, accounts payable, sales, and expenses.

Reconciliation:

The transactions are reconciled with external sources such as bank statements to ensure the accuracy and completeness of the financial transactions.

Financial Statements:

The software generates financial statements such as balance sheets, income statements, and cash flow statements for the business owner to review and analyze.

Accessibility and Collaboration:

Virtual bookkeeping systems also allow for easy access and collaboration, enabling authorized personnel, such as business owners, accountants, and other stakeholders to access financial data and records from anywhere, at any time.

Backup and Data Security:

Backup and data security are provided, such as cloud storage, to ensure that the financial data is safe and accessible in case of any hardware failure or data loss.

Why prefer Virtual Bookkeeping?

Virtual bookkeeping can greatly increase efficiency, reduce costs, and improve accessibility and scalability while providing additional security to financial data. It also provides businesses with more flexibility in managing their financial records and operations, which can make it an attractive option for many businesses.

Flexibility with Virtual Bookkeeping:

One of the key benefits of virtual bookkeeping is flexibility. Virtual bookkeeping allows for easy access to financial records from anywhere, at any time. This makes it convenient for business owners, accountants, and other stakeholders to access important financial information from anywhere, regardless of their location. This flexibility can be particularly beneficial for businesses with multiple locations or for business owners who travel frequently.

Virtual bookkeeping can also be flexible in terms of cost. Businesses can choose from different pricing models and packages that are suitable for their specific needs and budget, rather than having to pay for a full-time in-house bookkeeper.

Another advantage of virtual bookkeeping is that it allows for the hiring of remote bookkeepers, which can be beneficial for businesses where the availability of qualified bookkeeping professionals may be limited.

Furthermore, virtual bookkeeping software and tools can be configured to meet the specific needs of the business, rather than being locked into a single, inflexible system. This flexibility can help to optimize the efficiency and accuracy of bookkeeping processes.

Is Virtual Bookkeeping Legit?

A&I Financials come up with Virtual bookkeeping as a legitimate and preferred method of maintaining financial records for a business and compliance. It has been widely adopted by businesses of all sizes and industries as a way to increase efficiency and reduce costs. The professionals are certified and trained and are able to use their expertise to help business owners make important financial decisions.

Is virtual Bookkeeping Profitable?

Businesses can benefit from virtual bookkeeping depending on a variety of factors, such as the size and complexity of their business, the number of transactions, and the cost of their virtual bookkeeping service.

In general, virtual bookkeeping can be a cost-effective option for businesses, as it eliminates the need for physical office space, equipment, and other expenses associated with traditional bookkeeping.

However, to determine the specific profitability of virtual bookkeeping for a business, it is important to carefully consider the benefits involved and to consult with a virtual bookkeeping service or professional for advice and guidance.

What are the Benefits of Virtual Bookkeepers?

A virtual bookkeeper can bring a variety of advantages to a business such as,

- Increased Efficiency

Virtual bookkeeping allows for the use of digital tools and software, which can automate many of the manual processes involved in traditional bookkeeping. This can greatly increase the efficiency and accuracy of bookkeeping tasks.

- Cost Savings

It eliminates the need for physical office space, equipment, and other expenses associated with traditional bookkeeping, resulting in cost savings for the business.

- Accessibility

Business owners, accountants, and other stakeholders to access financial records remotely, which allows for easy access to important financial information at any time, regardless of location. This flexibility and accessibility make it a convenient option for managing financial records.

- Scalability

Virtual bookkeeping is flexible and can scale to meet the needs of businesses of all sizes, from small startups to large corporations.

- Data Security

Increased data security for financial data is offered as it can be stored on the cloud and be accessible only to authorized personnel.

- Focus on Core Operations

By having a professional handling bookkeeping, business owners can focus on their core operations, leaving the financial aspects to the experts.

Are Virtual Bookkeeping Services Scary?

It is natural to feel hesitant or uncertain about using virtual bookkeeping services, especially for business owners who have not used them before. However, virtual bookkeeping services are not inherently “scary” and can provide a range of benefits for businesses.

Why does A&I Financials offer profitable Virtual Bookkeeping?

Genuine Option

A&I Financials providing Virtual bookkeeping is a genuine option because it allows businesses to outsource their bookkeeping needs to a professional without having to pay for the overhead costs of a physical office.

Additionally, virtual bookkeepers are often experienced and qualified professionals who can provide accurate and efficient services remotely. This allows for a flexible, cost-effective, and secure way for a company to manage its financial records.

Better Cash Flow Management

Better cash flow management is ensured by A&I Financials, keeping accurate time records, which can be used to make informed decisions.

Also, it provides automated invoicing, identifying the areas for cost-cutting with projections and forecasting. It can help to plan accordingly to mitigate cash flow problems.

Hiring Trained Individuals

By choosing virtual bookkeeping services from A&I financials, you will get the services of highly trained professionals with specific skills and years of experience. These professionals have a broad range of abilities and are not restricted by geography, allowing us to assign them tasks that regular bookkeepers may not be able to handle.

Aside from that, when it comes to traditional bookkeepers, their rates can be very high. We can access well-trained and skilled bookkeepers at a fraction of the cost with virtual bookkeeping services.

In comparison with traditional bookkeeping, virtual bookkeeping services are approximately 30 to 50 percent less expensive, resulting in significant cost savings for small, medium, and large businesses.

Timely & Updated Financial Reporting

Our virtual bookkeeping services provide real-time financial reporting, as previously mentioned. Especially when things start piling up, bookkeeping can be one of the first things to fall behind. Even when tax season rolls around and you haven’t touched your books since the previous year.

Accounting is simplified with online bookkeeping since we can access financial reports virtually anywhere. Having updated financial reports allows your company to make informed decisions and minimize tax liabilities. It is well known that inaccurate books can have a variety of unpleasant consequences.

An erroneous profit and loss report, for example, could result in your company paying more taxes. If the report is understated, you would be underpaying taxes and possibly inviting a government investigation.

Before the end of tax season, you can make important tax decisions by reviewing accurate accounts before paying taxes.

Conclusion

Virtual bookkeeping can be a profitable business, as it allows bookkeepers to serve clients remotely and can be done on a flexible schedule. Additionally, with the widespread use of digital tools, virtual bookkeeping services can often be provided more efficiently and at a lower cost than traditional in-person services.

However, the profitability of a virtual bookkeeping business will depend on factors such as the size of the client base, the hourly rate charged, and the expenses incurred.

Overall, Virtual bookkeeping can be profitable but It depends on how it’s established, marketed, and run.

FAQs

How do virtual bookkeepers get clients?

Virtual bookkeepers can acquire clients through networking, referral marketing, advertising, and building an online presence.

Is there a demand for Virtual Bookkeepers?

Yes, there is demand for virtual bookkeepers as more businesses and entrepreneurs looking for flexible, cost-effective, and efficient ways to manage their finances remotely.

Is the Bookkeeping business profitable?

The bookkeeping business can be profitable, it depends on factors such as the size of the client base, hourly rate charged, and expenses. A well-run business with a diverse client base can be highly profitable.