9 Most Common Bookkeeping Mistakes to Avoid At All Costs

Avoid these costly mistakes when it comes to bookkeeping to ensure all your financial records and returns are in order:

1. Doing Your Bookkeeping Yourself

Whether you’re self-employed or a small business owner, you’ll usually have to wear many hats and wear them well. You work hard for your money and the last thing you want to do is to give one chunk to the tax authorities. If you outsource your business bookkeeping, all your critical accounts and financial reports would be managed by somebody else. You will have more time on your hand to concentrate on your business.

It will also be cost-effective to outsource. Even if you pay someone $50 an hour to do your bookkeeping work while you can make $200 an hour by concentrating on your business, it would be cost effective to do so.

Your goal is to grow your business and as it becomes bigger and more complex, so does the bookkeeping that goes along with it. You don’t need to learn a whole new area of study when you can hire someone to do it for you.

2. Not Chasing the Late Payments

Staying on top of your accounts receivable isn’t fun. It can be stressful when you’re relying on the money to come in and it’s not in your account. After all, you’re a business. You provide a service or product and you expect to get paid.

Make sure to establish payment terms so your customers are aware when to pay and your request for payment doesn’t seem out of the blue. Keeping up with your books will help you streamline your invoicing so that you can get paid in a timely fashion and you can then pay your bills the same way. Simple.

3. Failing to Keep Relevant Receipts

Holding onto receipts for business expenses is crucial. Misplacing these can either cause problems when you complete your tax return, or you won’t be able to claim back any expenses. Nobody wants that.

It might seem silly to store all your receipts for things such as stationery you bought but it would be helpful. Such as, if HMRC comes knocking, you’ll be able to provide all the necessary documentation to prove that your business expense write-offs are correct.

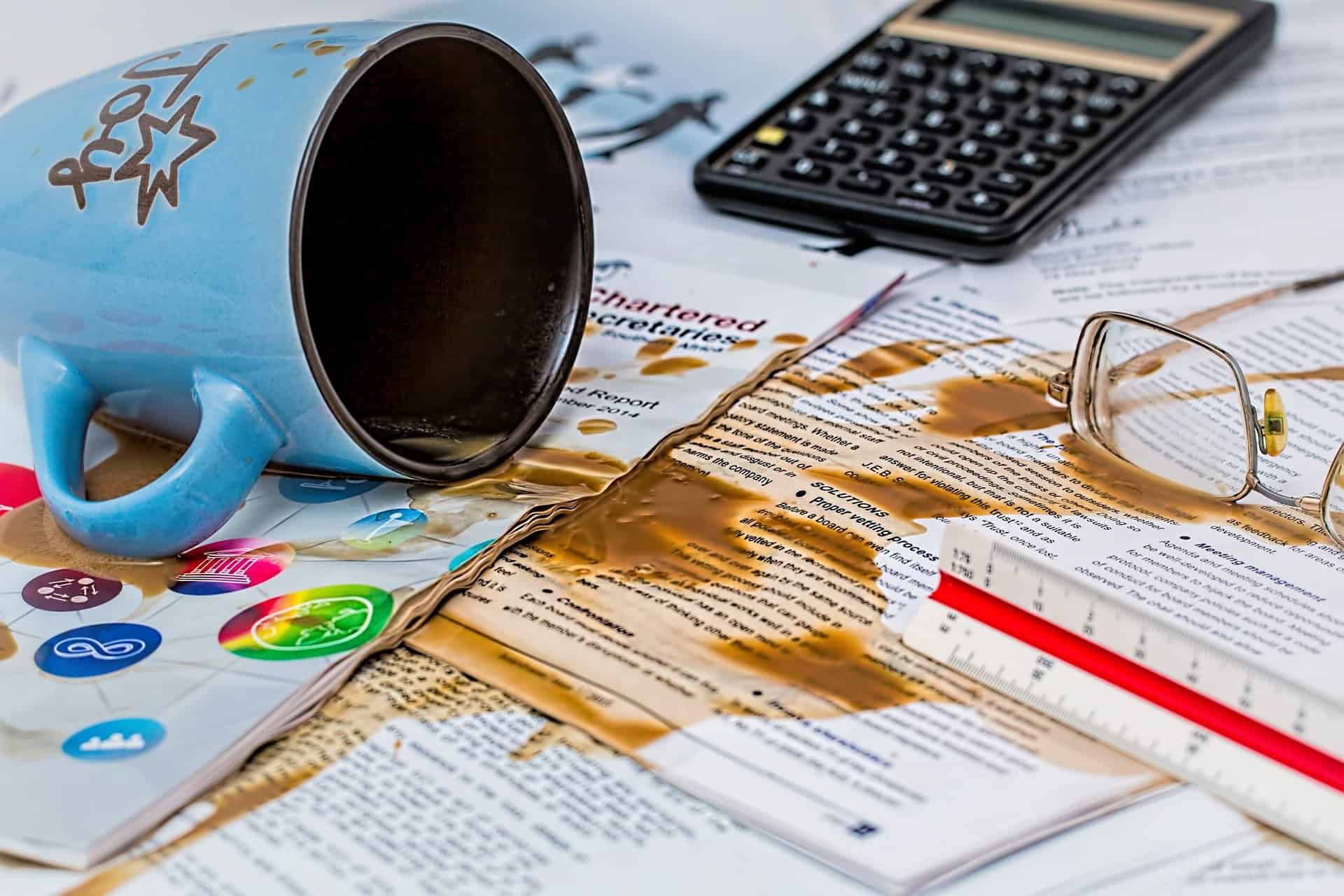

4. Carelessness When Bookkeeping

Neglect your books and the business won’t grow at the pace you anticipate. Not only are you doing a disservice to your business, but you can also open yourself up to potential fines in the future.

Here are some financial disadvantages that can happen if you disregard the importance of proper bookkeeping:

- Making poor business decisions based on inaccurate bookkeeping has a domino effect when it comes to hiring more staff, seeking loans and investing in new equipment.

- Organizing your current messy records, yourself, means you’ll waste time and if you’re cutting it close, mistakes can creep in.

- Expenses may be entered into the wrong category, making it harder to organize later on.

5. Combine Business and Personal Expenses

When your business is just starting, you might find yourself using a personal bank account or credit card to handle all income and expenditure. This makes for messy bookkeeping because all these transactions will need to be organized later on anyways. You also risk losing track of essential business expenses, which means missing out on beneficial tax write-offs.

You can avoid this situation by opening a dedicated business bank account early on. This way, your books will be much more accurate and easier to maintain.

6. Using Manual Accounting Systems

It’s no longer practical to input manual accounts records using a spreadsheet like Excel. Spreadsheets don’t provide a safeguard against incorrect data entry and other bookkeeping mistakes.

Businesses and those who are self-employed should opt to make the transition to an accounting system which is designed to catch simple errors which could cause major problems later on. Plus, nobody really has the time to sit down in front of a spreadsheet to crunch numbers when it can be done so much easier.

7. Using A Difficult-to-Understand Bookkeeping App

Did you know you can do bookkeeping from your phone? Using a bookkeeping app makes digital bookkeeping straightforward. When you look for one, make sure it includes the relevant features that you’ll need. You don’t want to overpay for features you won’t use and may not properly understand. Spend some time on researching the app before purchase and on learning how to use it after the purchase. No matter what app or software is being used, if user don’t have the knowledge and understanding of the system, it won’t be much useful.

If you don’t know how to use it, not only you’ll be making your financial life more difficult, but also you will not be complying with the Making Tax Digital (MTD) scheme. This will lead into more paperwork and more problems.

8. Keep Your Bookkeeping Mistakes in Check

Bookkeeping mistakes are common and costly but easily avoidable. If you’re wondering about doing your bookkeeping yourself, it is always helpful to get someone double check your work. This way, new set of eyes can catch the mistakes that were missed.

9. No-backups:

We are the part of the world that heavily depends on technology. Technology dependence can raise errors. Not having backups can be a serious problem in future prospects of the business. There is always room for uninvited chaos which can affect your data for which you need to be prepared. To avoid any bookkeeping error due to data loss, it is essential to keep proper backups for your data and evade potential losses. Having a cloud base solution can mitigate this risk.

Get Help from us

We are here to provide you Remote bookkeeping services for Your business at a reasonable cost. Contact our professional team for Expert Advice & Support just with one click and make your life easy.